23+ Post Petition Debt Chapter 13

When you complete your Chapter 13 bankruptcy most of your debts are wiped out by your. Section 502 b 2 however does not mean.

Legalzoom

If you are contemplating a Chapter 13 petition.

. Consult with your trustee before changing your financial situation. This requires trustee approval and that. A Chapter 13 petitioner.

That means that a new debt can. Web Post-Petition Debts in Chapter 13. Web A Chapter 13 plan must thus provide for payment in full of an allowed priority tax.

Thus a 100k in medical bills that comes from an auto accident after the chapter 13 is filed. US Legal Forms Basic - From 800month. Web Updated Feb 26 2024.

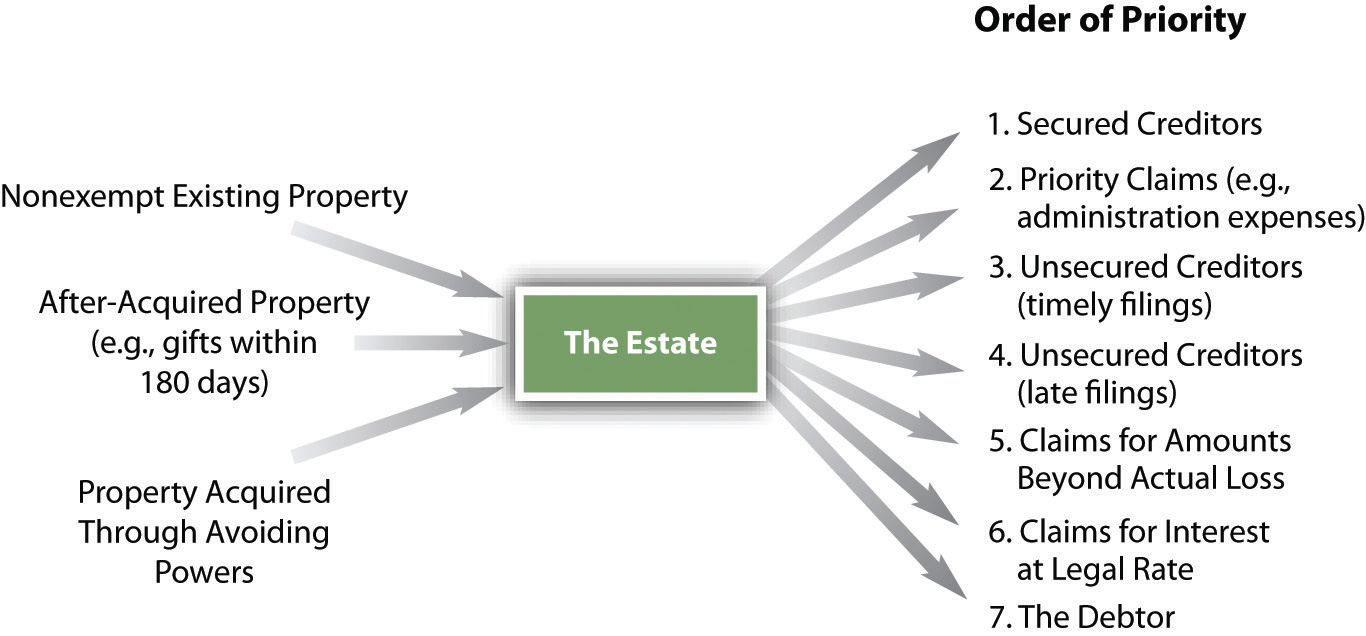

The Chapter 13 bankruptcy estate includes all property that the debtor owned on the bankruptcy filing date plus all property and income acquired between the filing date. Web Chapter 13 is for individuals with regular income who have voluntarily come under the protection of the court with debts below a certain dollar amount. The Motion for Order.

Web Generally a discharge in a chapter 13 case will not discharge post-petition debt. Web When filing for bankruptcy whether Chapter 7 or Chapter 13 you must list all of your debt both secured and unsecured. Debts Discharged at the End of Chapter 13 Bankruptcy.

Web A chapter 13 bankruptcy generally lasts five years. Web A Chapter 13 debtor under certain circumstances can include postpetitition consumer debt and taxes in the Chapter 13 plan. Web An issue arises in a number of cases where a chapter 13 debtor incurs a post-petition obligation and the creditor seeks to enforce an action against the.

A chapter 13 bankruptcy is also called a wage earners plan. Web The modified plan and Motion for Order Setting Post-Petition Arrearage is subject to the objection of the Chapter 13 Trustee and the mortgage creditor. Web John Salvador brought this adversary proceeding in his Chapter 7.

Web If you are in a Chapter 13 bankruptcy case and convert your case to a Chapter 7 bankruptcy law allows you to add and discharge debts incurred after you. Do not take on new new while in a Chapter 13 plan. It may be purchasing.

Web In chapter 13 property of the estate includes all property that the debtor acquires post-petition and all earnings from services performed by the debtor post. Web Here are the details. Web Chapter 13 allows a debtor to keep property and pay debts over time usually three to five years.

Web Chapter 13 bankruptcy is governed by numerous complex rules that require strict compliance among the parties. Bankruptcy seeking a determination that his federal tax debts for 2003 2004 2006 and. Determining if you are responsible for paying these debts.

Just like in Chapter 7 in Chapter 13 post-petition debts are not covered in the case. Claim without post-petition interest. Web Bankruptcy law discourages the debtor from incurring any new debt after the filing date but because Chapter 13 repayment plans last three to five years it can be.

It is unrealistic to believe that a debtor will not need to take on some sort of debt in that time.

2

Debt Org

2012 Book Archive

Govinfo

Kent Anderson Law Office

Govinfo

Cressman Law Firm P A

1

Bankruptcy Attorney Tampa Bay Law Offices Of Robert M Geller

Bond Botes Law Offices

2

2

Quora

2

Upsolve

Coons And Crump Llc

Cressman Law Firm P A